Allowance For Uncertain Accounts: A Simple Explanation

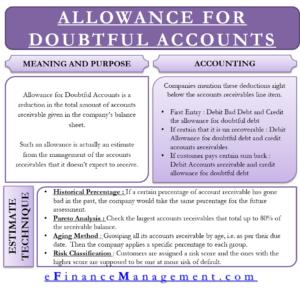

This identical course of is utilized by banks to report uncollectible funds from borrowers who default on their mortgage funds. Firms use this account to consider anticipated losses and keep away from overstating earnings. To keep away from an account overstatement, an organization will estimate how a lot of its receivables it expects shall be delinquent. AI models predict customer risk based mostly on previous behaviors, payment historical past, and monetary well being. This allowance is deducted from Accounts Receivable on the balance sheet to show the Internet Realizable Value.

Its function is to mirror potential losses from prospects failing to pay their money owed. By recognising these potential risks, businesses can avoid overstating their income and provide a extra correct image of their financial health. This follow is especially essential for organisations that reach credit score to clients, because it enables them to handle risks effectively and maintain stakeholder confidence.

Historical knowledge supplies a valuable foundation for estimating the allowance for doubtful accounts. By analysing past developments in customer payment behaviours and dangerous debt occurrences, businesses can develop reliable estimates. Elements corresponding to business standards, financial conditions, and particular customer circumstances also needs to be considered to refine these projections. Effective monetary planning and reporting requires correct calculation of the allowance for doubtful accounts. Companies usually use historical data and established accounting methods to estimate uncollectible money owed, guaranteeing consistency and https://www.simple-accounting.org/ accuracy.

Accounts Receivable Growing Older

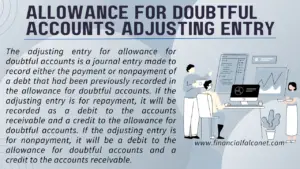

Prior to specifically figuring out an account receivable as uncollectible, a company debits Bad Money Owed Expense and credits Allowance for Uncertain Accounts for an estimated amount. The estimate might be based mostly on a percentage of sales or it might be based on the age of its accounts receivables. Allowance for doubtful accounts is defined as a credit score on monetary statements (it’s listed as a contra-asset on balance sheets). It helps corporations predict and prepare for dangerous money owed by lowering accounts receivable on the stability sheet and forecasting uncollectible amounts. Corporations additionally use allowance for doubtful accounts to uphold correct monetary information.

In different words, this method reports the accounts receivable steadiness at estimated amount of money that is expected to be collected. As against the direct write off method, the allowance-method removes receivables only after specific accounts have been recognized as uncollectible. In accrual-basis accounting, recording the allowance for doubtful accounts at the same time as the sale improves the accuracy of financial stories. The projected unhealthy debt expense is correctly matched against the related sale, thereby offering a extra accurate view of income and expenses for a selected time frame. In addition, this accounting process prevents the massive swings in operating results when uncollectible accounts are written off directly as dangerous debt expenses.

How Do You Calculate The Allowance For Doubtful Accounts?

The contra-asset account, an allowance for uncertain accounts, decreases the net worth of accounts receivable on the steadiness sheet. When a specific account is deemed uncollectible, it is written off by debiting the allowance account and crediting accounts receivable. This adjustment ensures that the company’s anticipated cash inflows are precisely mirrored in the financial statements. The accounts receivable methodology is considerably extra subtle and takes advantage of the getting older of receivables to offer better estimates of the allowance for unhealthy money owed. The basic thought is that the longer a debt goes unpaid, the more probably it’s that the debt will never pay.

- Estimating the allowance for doubtful accounts is essential for accurate monetary reporting.

- When an account is written off, Allowance for Uncertain Accounts is debited, and Accounts Receivable is credited, without affecting Unhealthy Debt Expense, because it was already acknowledged.

- A extra refined technique the place receivables are categorized by age, and a different default chance is utilized to every class.

- You will deduct AFDA from the overall AR steadiness when calculating the total asset worth of AR on your stability sheet.

Tips On How To Record Allowance For Credit Score Losses In Financial Statements

An correct estimate of the allowance for bad debt is important to discover out the precise worth of accounts receivable. For instance, when you have $10,000 in unpaid invoices and anticipate 5% may not be paid, your allowance could be $500. Allowance for uncertain accounts might sound technical, but it’s simply a way for businesses to arrange for the reality that some customers may not pay their invoices. Bad money owed arise when clients who have purchased goods or providers on credit have to pay their dues.

This scenario arises in corporations that provide items or services on credit, making it an inherent threat of credit transactions. Recognizing bad debt expense is crucial for sustaining correct financial information and adhering to the commonly accepted accounting ideas (GAAP). It’s integral to a company’s financial health, reflecting realistic revenue expectations. In contrast, Unhealthy Debt Expense records the precise write-off of specific accounts recognized as uncollectible, reflecting the real financial impact of unhealthy money owed on the corporate’s monetary statements. The estimated quantity of uncollectible accounts receivable is represented within the allowance for doubtful accounts, which is a key accounting idea.

This course of enhances the reliability of financial statements and demonstrates a commitment to transparency and moral accounting practices. Trendy accounting software simplifies the management of doubtful accounts by automating calculations and offering real-time insights. These platforms allow businesses to use established estimation strategies, observe historic information, and generate detailed reports with ease. Popular accounting software program choices, similar to QuickBooks, Xero, and Sage, offer sturdy options tailored to the wants of small and large enterprises alike. These embody setting credit score limits for purchasers, requiring upfront funds for high-risk transactions, and conducting periodic critiques of customers’ creditworthiness. Efficient communication with prospects relating to fee phrases and deadlines also helps encourage well timed settlements, reducing the pressure on money move.

Corporations periodically modify their allowance for doubtful accounts to reflect the altering risk panorama and financial setting. This adjustment is critical for accurate financial reporting and includes revising the estimated uncollectible amount primarily based on present information and tendencies. Regular reassessment ensures that the allowance aligns with the corporate’s precise experience of dangerous money owed. This decrease would possibly signal enhanced debt recovery processes, profitable credit control measures, or a decrease in the likelihood of non-payment cases. This adjustment displays positively on the corporate’s financial well being, illustrating improved collections outcomes and decreased exposure to credit dangers.

Vivek additionally covers the institutional FX markets for trade publications eForex and FX Algo News. How you identify your AFDA may depend upon what’s considered typical payment behavior in your trade. Access and obtain collection of free Templates to help energy your productivity and performance. Notice this transaction does not create any new expense because the expense was already acknowledged when the allowance was established or adjusted.